Today’s CFO wears many hats. They’re no longer just the company’s top accountant. They’re also a strategist, growth driver, risk manager, and tech adopter.

6 minutes to read

From steering financial planning to advising on investments and helping businesses pivot in fast-changing markets, the modern CFO’s role is bigger (and more complex) than ever.

With global uncertainty, evolving regulations, ESG reporting, and digital transformation all in the mix, CFOs are expected to stay sharp, move fast, and make decisions backed by data, all while keeping teams motivated and stakeholders informed.

That’s a lot to juggle. Which is why it’s become essential to have the right cloud-powered accounting solutions at hand to streamline workloads and help make their job smoother, smarter, and more strategic.

Challenge 1: Data Management and Accuracy

CFOs often spend too much time chasing numbers across multiple systems and siloed data across departments. Sales, expenses, payroll each might live in a different place, on separate spreadsheets, making it hard to piece together a full, accurate financial picture. What’s more, manual data entry only adds to the risk of errors and delays.

Cloud accounting can help by bringing all financial data into one centralised system. Automated data flows reduce the need for manual input, while real-time updates ensure everyone is working with the same accurate information. This makes it easier to create reliable reports, share insights, and make confident decisions without the hassle of jumping between spreadsheets and making crucial errors.

Challenge 2: Keeping Up with Regulatory Changes and Compliance

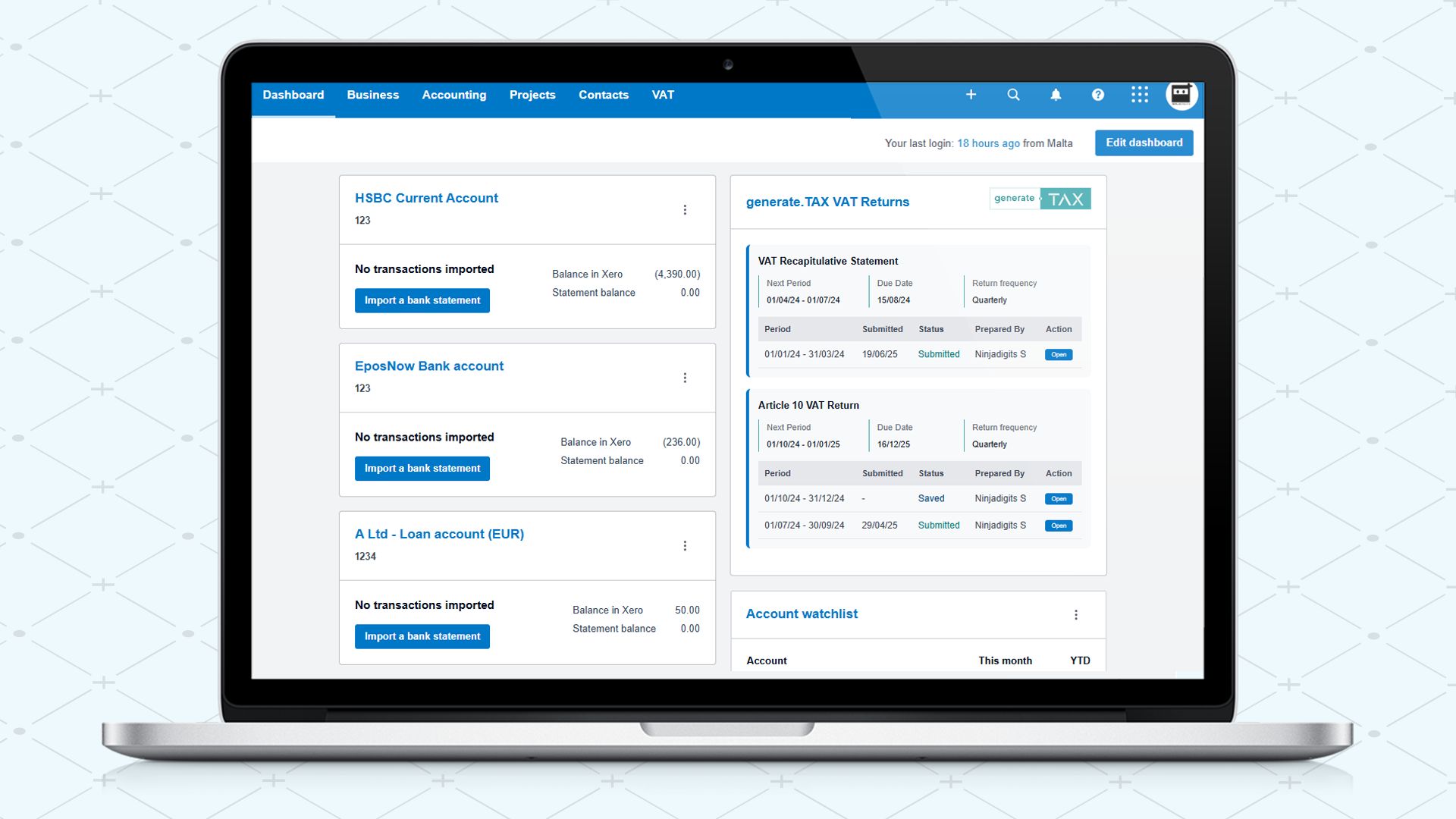

Staying on top of tax updates, reporting requirements, and accounting standards is no small task. Regulations are constantly evolving, and missing a change, no matter how small, can lead to fines, penalties, or compliance headaches.

Specialist cloud accounting software can lighten the load. Platforms like generate.TAX and Binderr come with built-in features designed to stay up to date with local tax laws and financial regulations. Regular automatic updates ensure you’re aligned with the latest requirements, while audit trails and reporting tools make it easier to show compliance when needed. This ensures CFOs can manage compliance without needing to monitor every policy shift manually.

Challenge 3: Forecasting and Strategic Planning

Making informed decisions about the future of the business can be tough when the data you need is scattered or outdated. It’s a common scenario where CFOs often struggle with limited visibility into current trends, making it harder to build accurate forecasts or plan for growth.

Here too, cloud accounting software brings greater clarity to the process. With real-time reporting and powerful analytics tools, it helps finance leaders spot trends, run scenario planning, and make faster, more strategic decisions. And to be clear, such platforms aren’t here to replace the CFO. Instead, they take care of the number-crunching so CFOs can focus on what they do best through interpreting the data, asking the right questions, and guiding the business with greater confidence.

Challenge 4: Cost Management and Efficiency

Keeping operational costs in check is always on a CFO’s mind. But when you’re relying on outdated systems, manual processes, and clunky infrastructure, inefficiencies can quietly chip away at your bottom line.

Taking advantage of cloud accounting software through subscription-based pricing, there’s no hefty upfront investment, meaning you can better manage costs across the year. Such solutions help automate routine tasks, cut down on errors, and help your team work faster and smarter. This results in better use of resources and real, measurable savings. What’s more, a healthier bottom line gives the business more flexibility to reinvest in what matters, whether that’s improving client services, growing the team, or exploring new revenue streams.

Challenge 4: Security and Data Protection

Protecting sensitive financial data is non-negotiable for any modern business. A single breach can lead to costly fines, and worse, loss of trust from clients and stakeholders. But keeping security systems up to date is no easy task. It takes time, expertise, and constant vigilance.

That’s why many CFOs are increasingly turning to cloud accounting solutions. Trusted cloud providers invest heavily in top-tier security features like data encryption, role-based access controls, and automatic backups. They also stay ahead of the latest compliance standards, so your business doesn’t fall behind. For CFOs, this means more peace of mind knowing that the company’s most critical financial data is protected by industry-grade systems.

The Benefits of Cloud Accounting at a Glance

Cloud accounting solutions are making the role of the CFO easier to manage in many ways, giving you the tools to lead with insight, agility, and resilience in a rapidly changing business world. That’s because, cloud accounting solutions:

Centralise Data: Eliminate scattered spreadsheets and manual errors by centralising your financial data in one real-time cloud system.

Stay Ahead of Compliance: Let built-in compliance tools and automatic updates keep you aligned with the latest tax laws and regulations, without needing to chase policy changes.

Make Forecasting Easier: Use real-time data and analytics to run smarter projections and guide strategic decisions with more confidence and clarity.

Control Costs More Efficiently: Ditch clunky, expensive systems for cloud-based tools that automate tasks, cut waste, and improve productivity saving both time and money.

Protect What Matters: Sleep easier knowing your financial data is secured with enterprise-grade encryption, backup systems, and up-to-date cybersecurity protocols.

Take the First Step Towards Smarter Finance with Scope

At Scope, we’ve spent years helping businesses streamline their finance operations through tailored cloud accounting solutions. As your digital transformation partner, our team of tech experts and qualified accountants understands the real-life challenges CFOs face, because we’ve seen them firsthand.

Whether it’s improving reporting accuracy, reducing manual work, or future-proofing your finance function, we’ll work with you to find the right fit for your business needs, workflows, and budget.

Curious about how cloud accounting can make a difference for your team? Book a no-strings-attached exploratory call today.